Get AfterPullback Screener

Use the AfterPullback Screener to discover targeted trading opportunities tailored to your specific trading setup

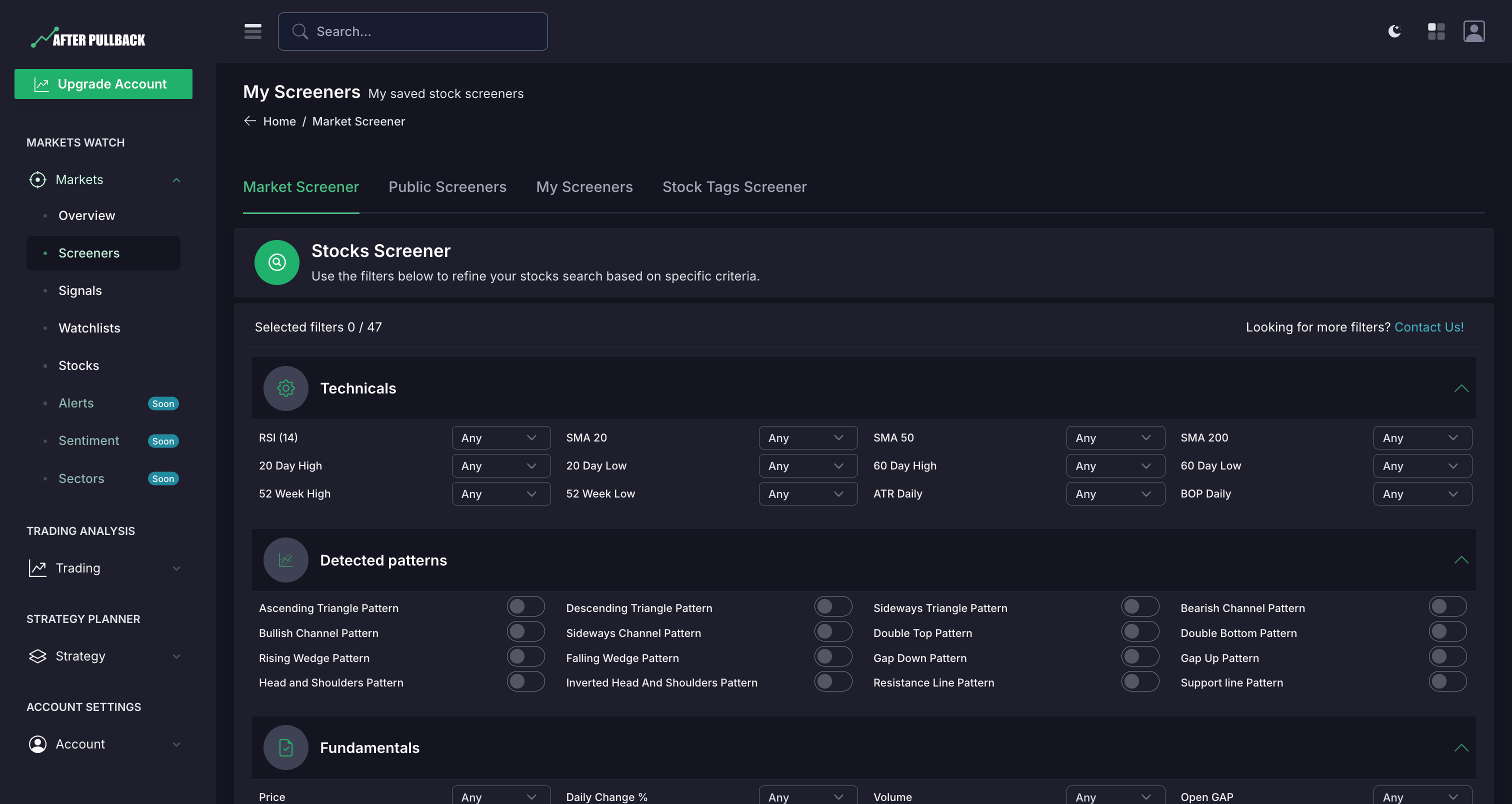

Start by accessing the Screener feature within AfterPullback. Navigate to the three main sections: Technicals, Pattern Detections, and Fundamentals.

After setting up the filters, you can either run the screener immediately to generate a list of stocks that meet your criteria or save the screener for future use. Saved screeners are stored in the "My Screeners" section, allowing you to quickly apply them without re-entering all the filters.

After running the screener, you will see a list of stocks that meet your defined criteria. This list will include relevant information based on the filters you applied, such as stock prices, moving averages, pattern detections, and fundamental data. You can further analyze these results to make informed trading decisions.

Manually researching and analyzing stocks can be time-consuming.You might miss out on potential trading opportunities without a systematic way to identify them. One of the most systematic ways to find your desired stocks is through

Stock Screeners.

The stock screener of AfterPullback is a powerful tool to filter and sort stocks based on specific criteria. These criteria can include various financial metrics, technical indicators, and other relevant data points. The primary purpose of a stock screener is to help users quickly identify stocks that meet their predefined conditions, making the process of finding potential investment opportunities more efficient and effective.

Efficient Analysis: You want to concentrate on undervalued stocks? Use a screener to filter out stocks with a P/E ratio above 30, for example, leaving you with a manageable list of potentially undervalued stocks to analyze further. The Screeners enable you to analyze a large number of stocks quickly. By filtering out irrelevant stocks, you can concentrate your analysis on a smaller, more relevant subset, improving your efficiency.

Precision in Stock Selection: Aiming to focus on stocks that exhibit strong upward momentum? Use a screener to filter for stocks trading within 2% above their 200-day Simple Moving Average (SMA), for instance. This precision enables you to concentrate on stocks that align with your momentum trading strategy. Did you notice how easily it streamlines your research process and enhance your overall trading effectiveness.

Customization: Every trader has his or her own trading strategies. Screeners allow you to customize based on your unique trading strategies. If you want to focus on a growth strategy, you can customize filters such as revenue growth rate above 20% and earnings growth rate above 15%. Alternatively, if you want to focus on a value strategy, you can customize filters such as a price-to-earnings (P/E) ratio below 15 and a price-to-book (P/B) ratio below 1.5. This flexibility allows you to adapt to changing market conditions and refine your stock selection process.

Consistency in Trading: By using screeners, you can maintain consistency in your stock selection process. This helps you develop a systematic trading approach, reducing emotional biases and improving overall trading discipline.

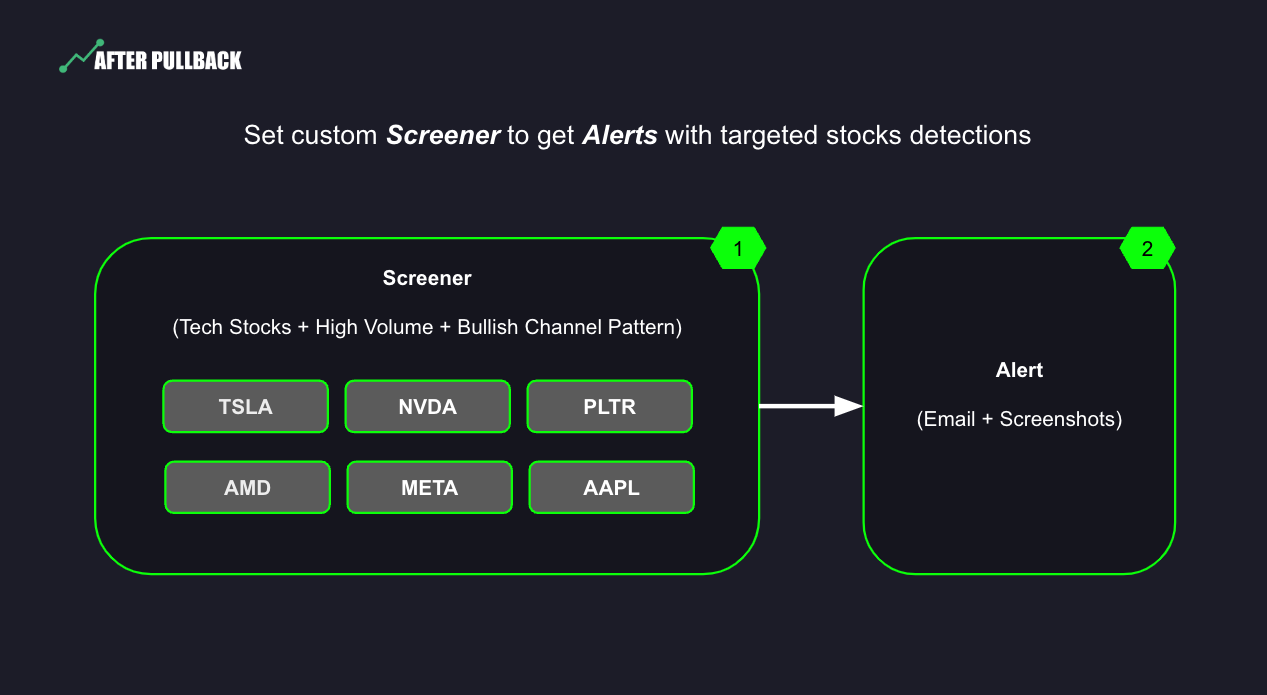

Alert Systems: Screeners at AfterPullback come with alert systems that notify you when stocks meet your criteria. This real-time information allows you to act promptly on trading opportunities.

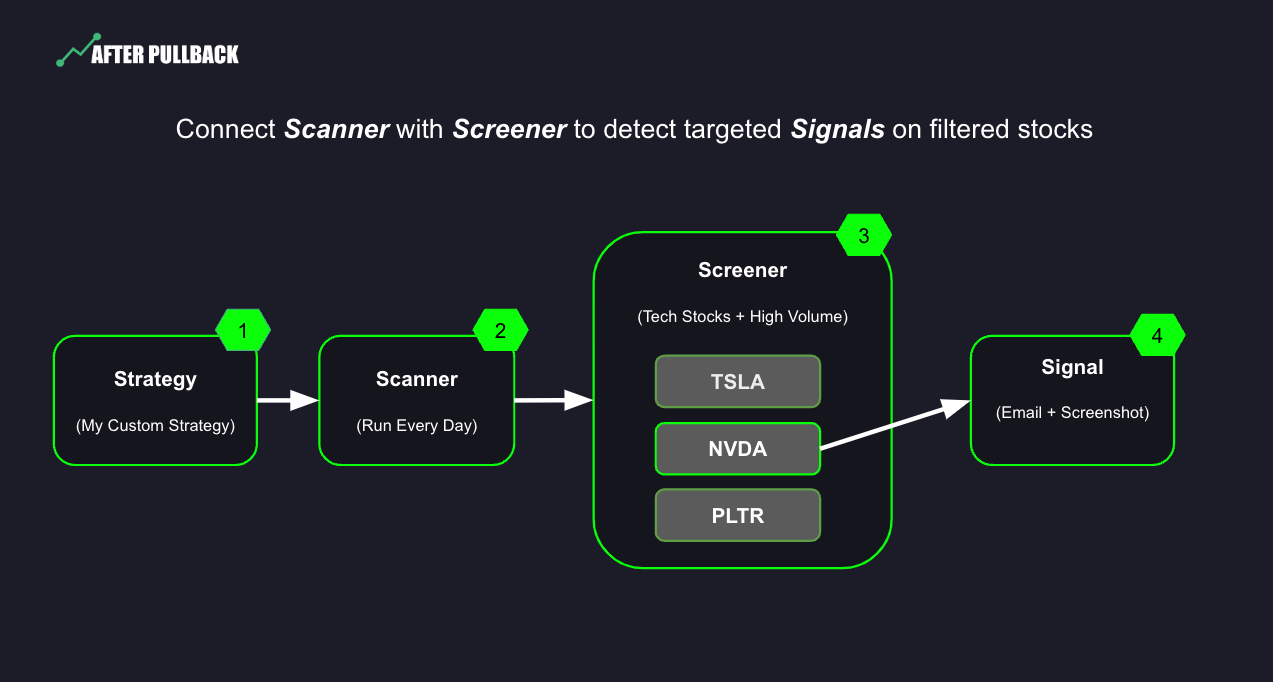

Additionally, you can combine the screener with a scanner for more precise analysis:

Define a strategy and launch a scanner based on specific technical conditions.

Assign the scanner to the screener you created, ensuring the scanner runs only on stocks meeting the screener’s criteria.

Receive email alerts with screenshots of the scanning results for further analysis.

We highly recommend reviewing our articles and resources tailored for active traders who want to enhance their trading knowledge.

If you're truly dedicated to the world of trading,

don't skip the must-read guide -

How to Establish a Stable Trading Strategy for consistent profits

GET THE GUIDE!