Get Strategy Backtester

Strategy Backtester designed to automate your backtesting and revolutionize the way you trade

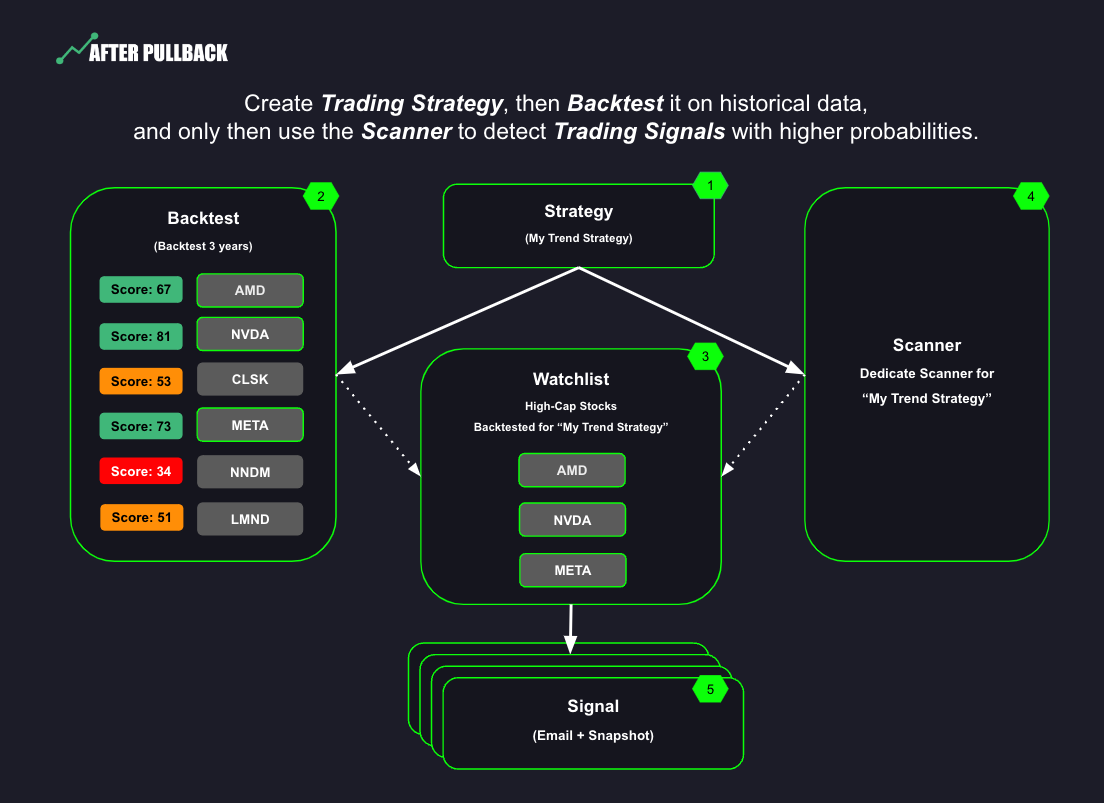

Your strategy can be based on different sets of parameters such as technical indicators, time-frames and more. After creating the set of rules for the strategy you will be able to re-use for multiple backtests.

After defining your strategy you should select and asset that you would like to test and define the historical time frame to backtest with your strategy It can be any stock or cryptocurrency that you like or specific assess that you detected using our Strategy Scanner based on your rules for scanning.

In the last step you can activate the Backtester to go over the historical data of that asset and execute a test trade every time it detected a combination of data that can represents your trading strategy and a potential detection for the Trading Detection tool . It will log and process all the information during backtest and convert it into a valuable report.

Backtesting a trading strategy is a vital and exciting part of developing successful trading approaches. It's like taking a trip back in time to test your strategy against historical market data. By doing so, you gain valuable insights into how your strategy would have performed in different market conditions.

No matter if you execute your trades manually or using automated tools such as our Trading Signals , you better backtest your strategy 1st to improve your accuracy. It's like having a crystal ball that helps you assess the strengths and weaknesses of your approach, identify potential flaws, and make informed adjustments to enhance its performance.

However, without automation, backtesting can be a daunting and time-consuming, and challenging task, since it requires a lot of effort to go over the charts and log each potential trade manually. This approach can generate a lot of mistakes, and every adjustment to the strategy will require to go over the data again and again. Fortunately, now you can say goodbye to the endless hours of manual research and low quality results and replace it with AfterPullback's Strategy Backtester to handle the task for you with the help of AI to score the strategy and improve the results.

Moreover, backtesting allows you to fine-tune your trading strategy with pre-defined and consistent conditions which can then be automatically identified using the strategy scanner with optimal entry and exit points based on historical patterns, trends, and indicators.

Additionally, backtesting acts as a risk management tool, helping you understand potential risks and rewards associated with your strategy. You can import your backtests into the integrated trading journal to simulate a trading period and get clear perspective on the strategy by quantifying factors like drawdowns and volatility, you can set appropriate risk parameters and effectively manage your trading capital.

We highly recommend reviewing our articles and resources tailored for active traders who want to enhance their trading knowledge.

If you're truly dedicated to the world of trading,

don't skip the must-read guide -

How to Establish a Stable Trading Strategy for consistent profits

GET THE GUIDE!